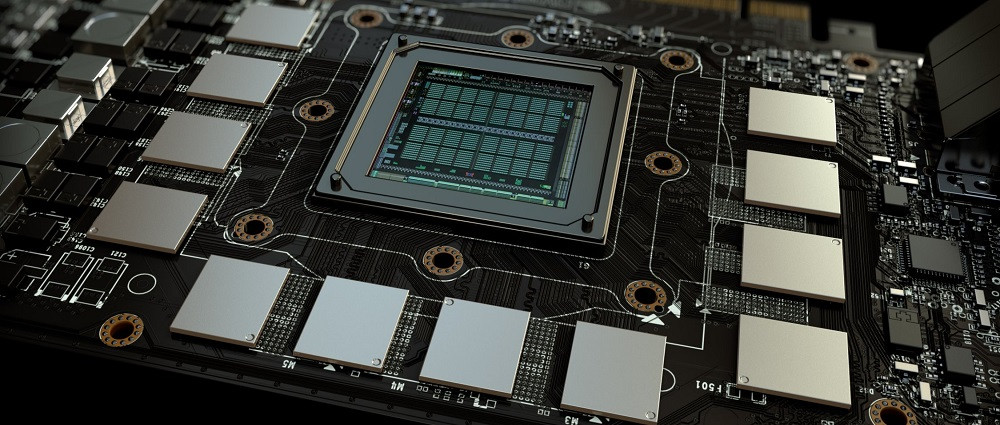

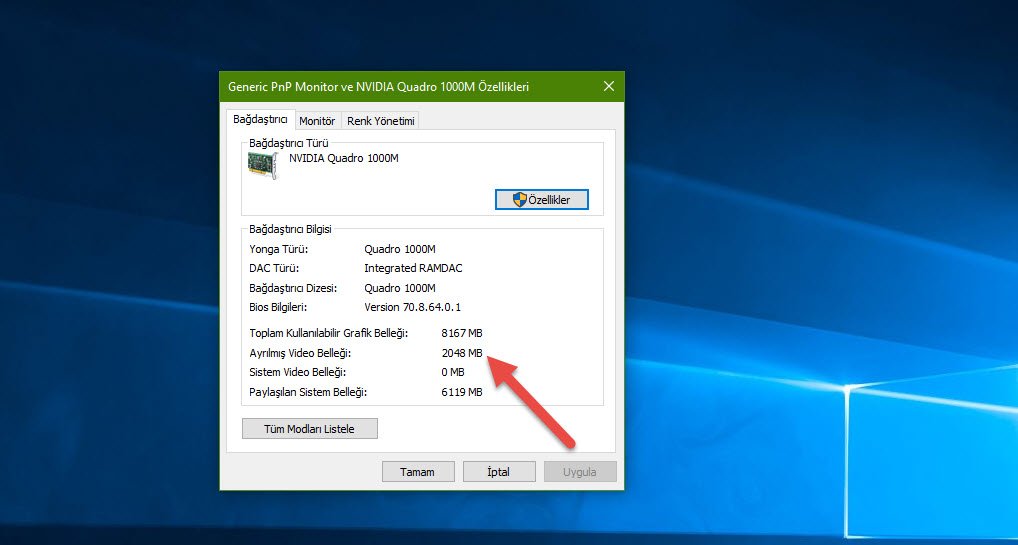

Oyun bilgisayarlarının olmazsa olmaz en güçlü parçaları: Ekran kartı, Ana kart ve RAM - Teknoloji Haberleri

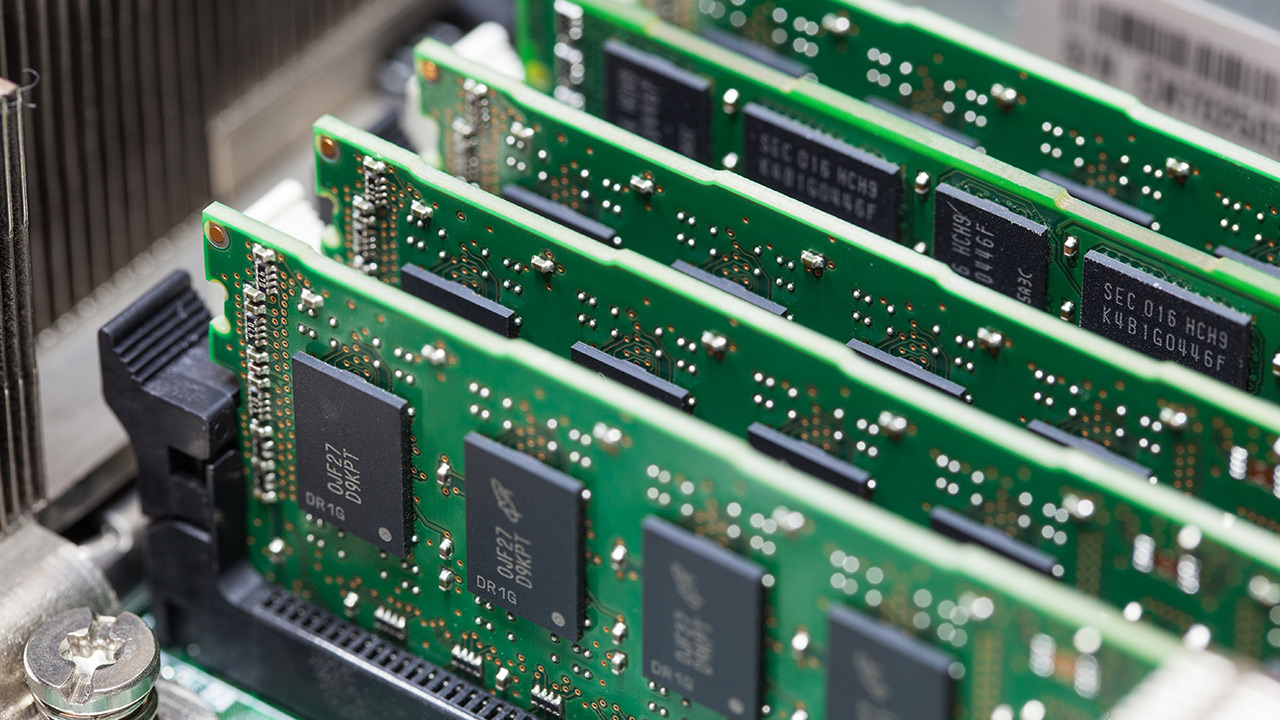

8GB LAPTOP'a 16GB RAM TAKTIM UÇTU! Oyun&Program HIZ TESTİ Laptop FPS Arttırma(Asus TUF FA506) - YouTube

Eski Bilgisayarı Hızlandırma Yenileme / Eski Bilgisayara SSD Takma / Ram Ekran Kartı Yükseltme - YouTube

Eski Bilgisayarı Hızlandırma Yenileme / Eski Bilgisayara SSD Takma / Ram Ekran Kartı Yükseltme - YouTube